University of Kentucky Federal Credit Union Login Updated FREE

University of Kentucky Federal Credit Union Login

PenFed — brusk for Pentagon Federal — Credit Wedlock was first established in 1935, and since then it'southward become 1 of the United States' largest credit unions. Like well-nigh credit unions it initially required members to share a common social bond; in PenFed'southward case members had to piece of work for i of several federal government departments. Authorities employees, uniformed service members, retired military and their families were all eligible for membership at the credit matrimony, and they currently make up a large portion of the electric current member population.

PenFed isn't as restrictive in its membership requirements today. People who volunteer for the American Red Cross tin open accounts, as can others who don't meet the traditional requirements. But eligibility is just i piece of the PenFed puzzle that might influence your choice to join. Reviewing some of the bank'southward other provisions and limitations can assistance you decide whether PenFed is the right credit wedlock for your needs.

How Are Credit Unions Different Than Banks?

When deciding if you want to employ for a PenFed membership, information technology's important to get-go understand the difference between credit unions and banks. A bank is a for-profit fiscal institution that's typically privately owned or publicly traded on the stock marketplace. You tin keep your money with the bank in a savings or checking business relationship (the simplest options). You may do other business at a bank, such as take out a loan for a mortgage, put money into a document of eolith or purchase another blazon of investment or financial product..

When you join a credit union, you go a member — a member who owns a modest portion of the credit union, which is prepare like a banking cooperative. Credit unions are non-profit entities, and member-owners typically control the credit union, meaning they vote to brand major decisions virtually how information technology operates. You'll also have access to traditional banking products like checking and savings accounts and various loans. You may also get other perks depending on the credit union. For example, PenFed members could get special seating at a Washington Nationals game, along with other local discounts.

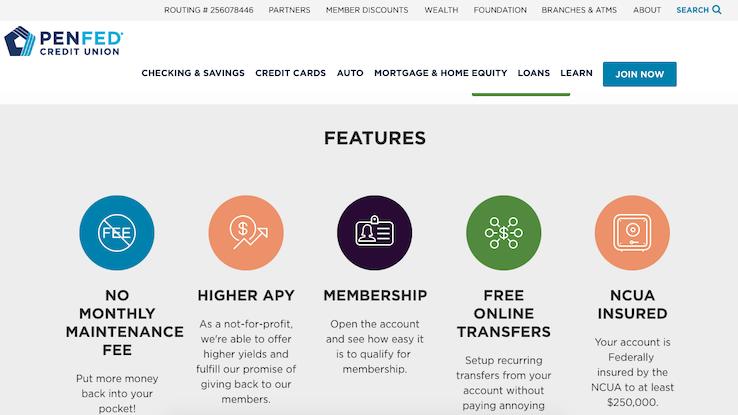

I of the biggest differences between for-profit banks and non-profit credit unions is that the goal of regular banks is to earn money — often from the people who utilise the bank. This means they typically charge more than (or higher) fees for transactions and that you'll terminate upward paying higher interest rates on loans in comparison to credit unions, whose objective is to get members lower rates on fiscal products. Credit unions commonly place higher importance on providing outstanding customer service and may accept access to free or depression-cost fiscal education programs. Because information technology's a credit union, you should look to savour this higher level of service from PenFed as a member.

How Does PenFed Rank Amidst Finance Experts?

PenFed received an overall four.0 (out of 5.0) score from NerdWallet, a finance company that aims to aid users improve their fiscal decision-making skills. This overall score is based on several of PenFed'southward diverse offerings, such as checking accounts, savings accounts and share certificates. NerdWallet was quick to point out that PenFed'south advantages included checking accounts that accumulate interest, which is not commonplace, and the fact that members take access to over 85,000 free ATMs beyond the state.

The site besides praised PenFed's higher almanac percent yield (APY) charge per unit — the rate at which interest accrues on an investment product — on online savings accounts. However, the reviewers criticized the depression APY on PenFed'due south basic savings accounts and its high $1,000 minimum investment on share certificates. Additionally, PenFed does not participate in shared branching, which means you tin can't withdraw funds or perform other transactions at other credit unions. This is a characteristic that many credit unions offering.

Bankrate, some other consumer financial services company, also rated PenFed on its offerings, giving it an overall score of three.half-dozen out of v.0. One advantage that Bankrate pointed out was the ability to perform many banking functions at the same institution. For case, PenFed offers everything from depository financial institution accounts to mortgages to dwelling loans, so it could become your one-stop financial shop depending on your needs. However, there are not many PenFed branches around the United States. If yous prefer local banking and y'all're not in the Washington Metropolitan Area that includes parts of Virginia and Maryland (or in some areas of Texas and the Midwest), you may want to wait elsewhere for a credit marriage that'due south more attainable.

How Does PenFed Compare to Other Credit Unions?

If yous're part of PenFed's target consumer grouping of military members and federal government employees, y'all may be interested in other financial institutions that primarily operate for service members. Navy Federal Credit Wedlock is one of these banks, and it carries a iv.5 star rating from NerdWallet. The site's reviewers praised Navy Federal's accessibility, noting that information technology has branches available worldwide while PenFed is express to a pocket-sized geographic area. This credit union also has few fees and offers competitive rates on its share certificates. One area where Navy Federal doesn't stack up? Its eligibility, which is limited to members of the armed forces, Department of Defense employees and their corresponding immediate family members.

Security Service Credit Union, which was founded to benefit select members of the U.S. Air Force, is another similar institution. Like PenFed, it's rather limited to one area of the country, but information technology's a larger ane encompassing parts of Utah, Texas and Colorado. Membership isn't as limited; if you lot're a resident of one of those states, or if you meet several other criteria, yous're likely to qualify to bring together. NerdWallet also highlighted the fact that Security Service Credit Union participates in shared branching, which is helpful if you adopt to take intendance of financial matters in person.

University of Kentucky Federal Credit Union Login

DOWNLOAD HERE

Source: https://www.askmoney.com/credit-cards/is-penfed-better-than-other-credit-unions?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: givenscalown.blogspot.com